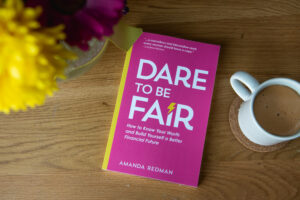

Amanda Redman’s book Dare to Be Fair equips women with the right information to take control of their finances and shape their future.

Drawing on her own experiences as a woman in the corporate workplace, a working mother who launched her own business and the many women she has worked with, Amanda’s book addresses why women are being financially disadvantaged in life, how we can change the status quo and the tools needed to do so.

“I’ll start by saying that I’m not a writer by profession, I’ve never written a book before or undertaken anything similar… and somehow, I felt compelled to write this one,” she said.

“Throughout my corporate career and profession as a financial adviser, it’s struck me that the corporate workplace is still not set up to enable women to succeed. From barriers to going back to work after having children, to remuneration structures that reward longevity of service and those prepared to negotiate over salary, I saw that a change needed to happen.

“It also became increasingly apparent to me that many women I have worked with feel less confident about their finances than their husbands or partners do and are not getting involved in planning for the long-term. I don’t believe that women are any less capable of understanding and taking control of their financial plan, so why don’t they? With the right guidance and information, all women can understand, plan and create the best financial future for themselves and their families, and that’s what my book is setting out to do.”

Dare To Be Fair challenges women to assess their current financial situation and start to create a financial plan that will equip them for later life. It will also help them to consider their position in the workplace – their remuneration and career opportunities – and give them ideas to help change this, to achieve greater fairness in their life.

Some of the issues Dare To Be Fair tackles include:

Becoming self-sufficient

Unfortunately, in Amanda’s experience, the first time many women sit down to look over their finances is in the wake of a crisis, be that a bereavement, ill health or a divorce. If you can be fully aware of your and your partner’s financial situation now, you’ll be better prepared to deal with any changes that life throws at you.

Work after children

The current ‘norm’ seems to be that once a woman has had a child, she’s likely to return to work part-time – Dare To Be Fair will open your eyes to the consequences of this. The reality is, working part-time is likely to leave you with less chances of advancing your career, less ability to save for your future and a smaller pension pot than your partner.

Workplace cultures

It’s no secret that corporate workplaces have been shaped by men over decades. So, how can we go about changing years of female underrepresentation?

Talking to our friends

We can all be part of the solution. Dare To Be Fair will help you instigate conversations with your friends, children and family members so that we can start to change the narrative for other women.

As well as pointing out the reasons why women are often less financially confident than men, Amanda’s book offers women practical tools to help achieve greater equality, whether at home, within the workplace or in society including:

How to create a financial plan

If you want to fully understand your financial situation, it’s best to create a financial plan. Amanda breaks the process down into smaller stages, making the whole thing less daunting.

Understanding your pension

Pensions are confusing but that doesn’t mean that you can just stick your head in the sand and ignore them.

“One of the biggest motivations for me writing my book was the fact that many women in their mid-60s are retiring in relative poverty, or are having to continue working because they can’t afford to retire” Amanda said. “If we understand how pensions work, we can take action now to avoid not having enough money to see us through the later stages of our life.”

Changing how we view money

Many of our attitudes towards money now will have been shaped by our early experiences with it. For example, if money was scarce when you were younger, you might feel like you can’t spend anything now; or, if money was a taboo topic in your house, you might not feel comfortable discussing it. Dare To Be Fair touches on creating a healthier relationship with your money and finances.

How to fight for fair at work

As women, we’ve probably all experienced some level of direct, or indirect, discrimination in the workplace. That might have been not being able to return to work on the same paygrade or in the same role after maternity leave, finding out your salary was comparably smaller than a male colleague or not feeling like putting yourself forward for a promotion when male colleagues have no issue with doing so. This book sets out actions you can take as an individual, and also top-down strategies that organisations can implement in a bid to ensure greater financial fairness between the sexes.

Creating a more equal relationship

Although Amanda is a huge advocate for women returning to work post-children, for some families this is not the right decision. Whether you work again or not, there are ways to ensure that you remain financial equals regardless of who earns or works more, such as the main breadwinner paying into the wife’s pension so she is not financially disadvantaged in retirement.

Dare To Be Fair is available via Amazon, or www.dare2befair.com.